When companies do not have the funds to realize their initiatives, they can turn to external financing. However, the question of investments often needs to be addressed for many business entities launching their projects.

Today, investments come in different types and forms, and venture capital is one of them. In this blog post, we offer to look at this notion from various perspectives and analyze its different aspects, including, but not limited to, venture capital fund stages, the most attractive sectors for investments, ongoing trends, and future predictions.

Venture Capital Definition: What is it?

To begin with, we should explain the meaning of the term under consideration.

Today, venture capital funding is considered one of the key capital sources for businesses that can’t rely on financing via traditional bank programs due to the high level of associated risks and the lack of possibility to prove their success.

Who traditionally acts as venture capital investors? Such funding usually comes from individual investors, financial institutions, and industry leaders. Though VC support usually presupposes financial help, it can also come in the form of managerial or technical expertise.

Today, venture capital returns can be higher than in other investment forms. This explains why venture capitalists are ready for risk when they believe the chosen project will succeed.

If you are looking for a development team to help you transform your ideas into an actual product, at Geomotiv, we will always be happy to help you!

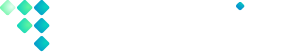

Venture Capital Fund Stages

Different stages of financing take place at various stages of startup development, and consequently, the funds raised are allocated to cover other needs. Let’s look closely at the critical steps of the venture capital cycle.

Pre-seed funding stage

Pre-seed funding is typically devoted to starting your business activities, developing a concept, establishing the necessary contacts and partnerships, etc. In other words, entrepreneurs estimate the viability of their ideas and get their operations off the ground. Of course, at this initial phase, it is too challenging to attract venture capitalists as they can’t fully evaluate the potential of your project. That’s why startup founders often rely on their resources and personal contacts.

Nevertheless, the role of this stage shouldn’t be underestimated. It’s time to elaborate an efficient business model and develop a future business strategy. Moreover, during this period, startup founders should take care of the legal aspects of their project's functioning, as venture investors won’t be ready to support businesses with open legal questions and gaps later on.

Seed stage funding

At the seed funding stage, companies traditionally already have some experience and can demonstrate their first achievements that prove their potential. To attract the attention of investors, startup founders should prepare a pitch deck. It is a presentation that contains the main information about a business idea, services, products, etc. Providing a project roadmap and mentioning its strengths and unique features is also essential.

How do startups usually use funds invested at this stage? These funds can be allocated to conducting market research, hiring and setting up a management team, developing a product prototype, etc.

The critical goal of securing funding at this step is to invest it wisely in business development and demonstrate your business's growth and scalability in the future.

As for the equity, startups must give up to secure the investment at this stage. This is the most expensive funding. Why? This happens because investors consider the risks at this stage to be the highest. And the higher the risk, the higher the reward for them.

Series A stage

By this stage, companies usually have their MVPs or even full-scale products developed, they have a well-designed roadmap, and their pitch decks can highlight product-market fit. With all these things done, they can actively expand their customer base, grow their partnership network, implement ad and marketing strategies, and even demonstrate their revenue flows. As a result, investments in startups at this stage do not look as risky to VC firms as at the seed round.

How can startups use the raised money? Generally, this money is used to expand their teams and fine-tune products, services, and business processes.

In the Series A round, it’s not enough to show investors that you have a lot of customers or users now. It’s more important to demonstrate a clear long-term vision. That’s why businesses should explain to investors their plans for the future and how they will monetize their projects in the long run.

Series B stage

This funding stage supports general business operations, including sales, marketing, product management, improvements, etc. There is an essential difference between Series A and Series B funding.

In Series A, investors mainly consider startups’ plans and estimate their potential. In Series B, they must analyze businesses' actual performance, evaluate the commercial success of products or services, and consider business development dynamics. Performance metrics assure investors that allocating funds to this or that project is worth it.

The funds raised are usually spent on further business expansion and scaling of operations.

Series C stage

The Series C funding stage comes when a startup is already growing. By this time, it has already achieved some heights, and investors can see whether there are any prospects for this business in the future. The funds raised at this stage are traditionally used to introduce new services and products, enter new markets, or acquire other projects.

Of course, to reach this stage, startups need a well-established customer base, which requires some time. Usually, this period takes 2-3 years or even longer.

Moreover, when investors consider different startups for support at this phase, they think about their history of growth, the stability of revenue streams, and their ambitions for expansion.

What’s next?

Startups may have different ways of proceeding after a traditional series C stage. The following phase is known as the mezzanine or bridge stage. Here, companies have already reached their maturity and need to decide how to move to a liquidity event.

In other words, they need to decide how investors who supported them as early-stage startups will cash out their equity. There are several ways to accomplish this, including a merger, acquisition, or initial public offering (IPO).

When companies enter this stage, they should already be full-fledged businesses. However, many investors who helped them achieve this level may prefer to sell their shares now, which can allow them to earn a good return on investment. With original investors leaving, business owners can also sell their shares or make their companies' stock publicly available.

Series D and E stages

However, there can be some alternative ways before going for an IPO or ending the history of the company’s existence.

The traditional structure of the VC funding lifecycle usually includes only the series A, B, and C stages. However, there can be subsequent phases as well. They are called series D and E. Nevertheless, only some companies make it to them after they finish raising funds with their Series C.

But why do companies proceed to Series D instead of following a more traditional scheme? They can be different. First, they may have found new expansion opportunities that they want to use before going public. That’s why they may need to raise their Series D (or even E) rounds to increase their value. Moreover, some companies may prefer to stay private instead of offering their shares to a broad audience. Nevertheless, they may still need funds for development, and series D and E rounds can be a good solution for them.

Moreover, there can also be some less favorable reasons for these additional funding rounds. Some companies may be unsatisfied with the results of their Series C rounds, and that’s why they need to conduct a new round of funding that is often called a “down round.” In this case, businesses have a lower valuation than in their previous round. Such downturns can help companies stay afloat and get over hard times. However, such an initiative has a negative effect - its stocks are evaluated. Moreover, it may be challenging for them to raise funds in the future after down rounds as investors will already know about their difficulties.

Alternative Classification of Venture Capital Funding Stages

There are other approaches to classifying funding stages, and some analysts rely on them in their studies. In general, they include the same rounds, but they are grouped differently.

- Angel/seed stage. It includes the first rounds, like the pre-seed and seed stages. The raised funds are allocated to sponsor the first operating activities, and the founders' budgets very often cover such expenses. Nevertheless, these rounds may also be supported by “angel investors.” They are usually wealthy individuals ready to help startups with comparatively small amounts of money at the beginning of their business journeys.

- Early. This step is traditionally composed of the Series A or Series B rounds.

- Late. This phase includes all the venture capital received within the period when a business has already started generating revenues but before it goes for an IPO. In other words, it can include the Series C, D, and E rounds. The funds raised can be used to expand business activities, improve products, make mergers or acquisitions, and form the budget for the bridge stage.

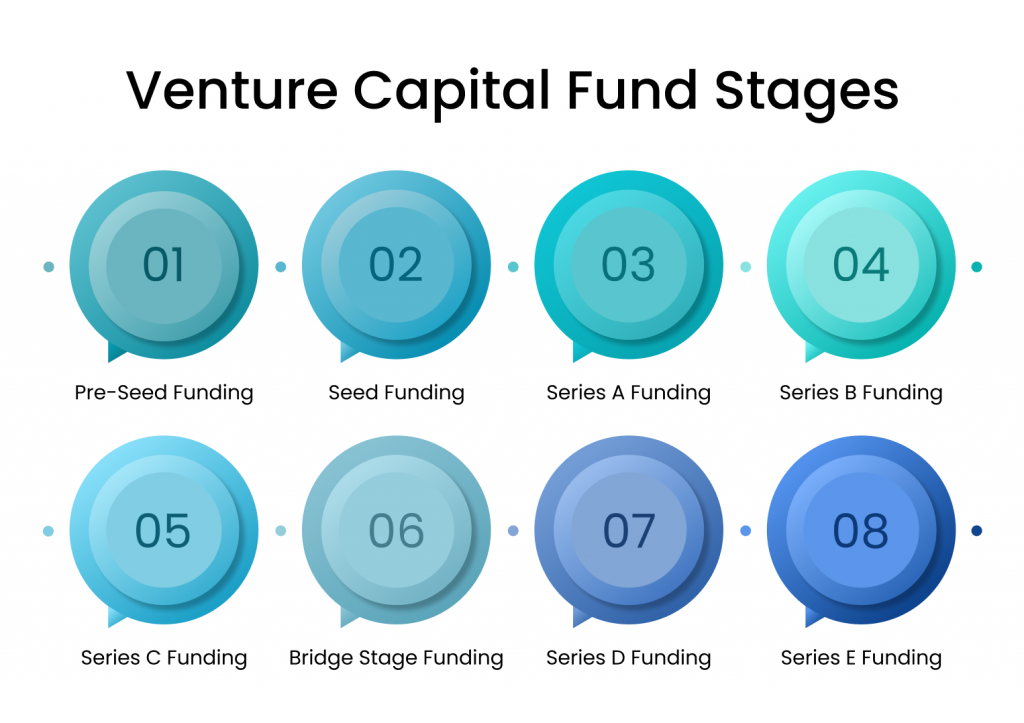

How Venture Capitalists Choose Companies to Invest in

Thanks to venture capital, even startups with no operating history can successfully raise funds and launch their projects. But what factors do investors usually consider if there is practically no proof that can demonstrate the company’s results of work?

As a rule, they estimate:

- The project’s growth potential. It’s crucial to think about the current moment and your business's future journey. Potential investors always consider businesses' capacity to scale and differentiate their revenue streams.

- The expertise and vision of the project’s management team. It’s vital to look at a team that manages the business and the qualifications of those who make final decisions. There is an opinion that a venture capital firm would prefer to invest in a bad company with good management than in a good company with poor management. Sometimes, representatives of VC firms may even join a company’s board for some time to see what is happening behind closed doors.

- The uniqueness of the project’s services or products, goals, use cases, and potential interest from the side of end users. Various studies have demonstrated that more than 30% of businesses fail because of poor market fit. That’s why investors must analyze the business offerings and see whether they correspond to the market needs.

- The size of the market. Investors always consider the target markets of the projects under consideration. As a rule, a good market size means it can generate at least $1 billion in revenue for them. The general principle is that the more significant the market is, the higher the chances for businesses to generate millions in revenue. When a company can potentially earn millions, for venture capitalists, it means that they can exit the investment practically at any moment and get their profit.

- Previous investments. Investors always need to find out whether the company has raised any funds before, how the received money was used, and who supported businesses at earlier stages. They also consider the reasons for conducting additional rounds, like series D. If the company needs to get extra investments because it failed to use the previously received money feasibly, it may be quite challenging to convince investors to support such a firm.

Of course, over the years of their work, VC firms could face several losses even with diligent preliminary analysis of projects. Nevertheless, with more time and experience, investors get a better understanding and a more well-developed intuition when making choices. That’s why many young VC firms try to follow the guidance of more experienced venture capitalists.

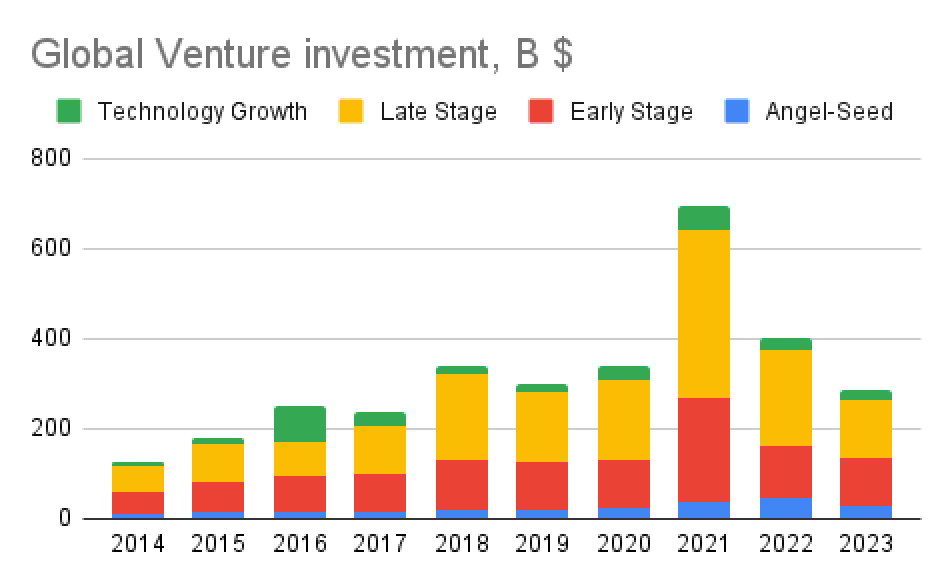

Venture Capital in 2024: What’s Happening Now?

The first quarter of 2024 hasn’t been successful for global startup funding. According to Crunchbase data, it was the second-lowest since the beginning of 2018.

The amount invested in startups in Q1 2024 hit the mark of $66 billion, indicating a 6% increase compared to the previous quarter (Q4 2023). Nevertheless, it is still 20% down year over year. The figures are different from other sources (like the report published by KPMG). According to KPMG experts, the total amount of invested funds is %75.9 billion.

This difference appears due to the need for standardized data collection methods. Nevertheless, experts across various organizations highlight one fundamental idea. They all speak about the fall in VC investment that we can observe now.

Below, you can find the table with figures that demonstrate the changes in venture capital funding from Q1 2021 to Q1 2024. In the table, you can see the amounts invested at different stages. Technology growth can be defined as a round of direct investments raised by a company that has earlier conducted VC funding rounds (it means that it could be any of the known funding stages).

Up till now, Q4 2021 was the most successful quarter for startups. At that time, startups managed to attract over $190 billion.

In general, 2021 was the most successful for startups that tried to raise capital from investors. That year, young businesses received $694.1 billion in funding. Just for comparison, in 2023, this figure was $285.4 billion. Nevertheless, despite the fall in VC that we can observe now, many experts are pretty optimistic about what will happen soon.

It is projected that 2024 global venture investments will hit the mark of $468.4 billion.

Which Sectors Attracted the Most Investments in Q1 2024?

If you are considering launching your own startup, it will be helpful to find out which sectors currently attract the highest attention of investors.

The leader is healthcare and biotech. Companies working on such projects attracted $15.7 billion, 24% of all global funding in Q1 2024.

Another primary sector in this aspect is AI. In total, startups in the AI market managed to attract around $11.4 billion in investments in just one quarter. This figure takes around $17% of global startup funding in Q1 2024. For example, in January 2024, AI companies received $2.2 billion; in February, the invested amount reached $4.7 billion.

If we consider separate months, March 2024 was a month in which the technology, media, and telecommunications sectors received the largest share of the value of funding rounds, over 28%. The consumer sector attracted over 25%, while the healthcare industry received around 16% of global investments.

Venture Capital Trends

The venture capital investment space is dynamic and greatly influenced by general market tendencies. If you are interested in venture capital fundraising, it would be sensible to stay updated to understand what is happening in this industry.

Our team attentively analyzed the market situation and created the following list of trends and predictions for venture capital financing.

Trend 1. The hype around LLMs won’t last forever.

When ChatGPT was officially made publicly available in November 2022, the hype around it was enormous. Society was divided into two camps: while some people were genuinely inspired by what large language models (LLMs) could offer, others were intensely preoccupied with their potential impact on the labor market. Many entrepreneurs tried to launch their chatbots and other AI-powered tools equipped with LLMs' capabilities. And the progress made in this space is breathtaking. However, investors have started paying less attention to these projects.

Nevertheless, we should stay realistic. Unfortunately, many startups stopped development, and now they have two options: either to cease operations or to change the sphere of their activities and address less hype-related tasks.

This situation is a perfect demonstration of Amara’s law. According to it, we often overestimate the short-term impact of new technologies while underestimating their long-term implications.

Trend 2. Tech mergers and acquisitions (M&A) will thrive in 2024.

The tech industry is expected to undergo a series of mergers and acquisitions shortly. For many startups, selling their projects will be the most innovative and most feasible solution amid their struggle to raise funds.

At the same time, large private and public tech firms will likely be open to empowering their balance sheets by adding new products and services to their portfolios via acquisitions. Such initiatives from their side can help them get new customers, win a more significant market share, and cement their leadership in the industry.

Trend 3. Rebound in VC fundraising will be observed.

2020 and 2021 were highly successful for companies looking for venture capital funding. Unfortunately, in 2022 and especially in 2023, the industry experienced an apparent fall. Nevertheless, it is expected that 2024 will become a year of rebound.

Will it be a long-term trend? The time will show. Nevertheless, now experts are optimistic.

Trend 4. IPO activity may start gaining momentum again.

At the beginning of 2024, IPO activity registered its lowest level since 2016. The reasons for this look quite weighty. What are they? The ongoing market volatility, swelling interest rates, and growing geopolitical conflicts in different regions. However, together with the positive changes in fundraising, we can detect some signs indicating the end of the “IPO winter”.

Already in March 2024, we could observe signs that demonstrated investors' readiness to support newcomers, late-stage startups, and well-established firms.

For example, the first VC-backed IPO of 2024 was conducted by Astera Labs, a company that offers purpose-built connectivity solutions powered by AI and cloud technologies. On its debut day, its shares closed trading 72% up.

Trend 5. Leading sectors in venture capital financing will strengthen their positions.

Even though the VC space is experiencing some challenging times, the top trending sectors are still forecasted to stay vital in attracting investments. IT, healthcare/biotech, and business/financial services are these sectors. Among other promising spheres, we can highlight renewable energy, consumer goods and services, and industrials.

Countries with the Most Significant VC Investment

According to various sources, the top 5 countries are:

- USA;

- China;

- Israel;

- Singapore;

- Canada.

Analysts expect VC investments in the United States will reach $264.5 billion in 2024. But why are these countries among the leaders? The key reasons are the conditions they have created for investors and the potential that the investments in their projects and economies may have.

Countries worldwide try to implement various strategies to attract foreign investments. These strategies often include regulatory adjustments, financial policies, and economic incentives to ensure the most favorable investment climate.

Government Initiatives

Governments can take some steps to attract investments in projects realized in their countries or create their own business entities there.

- Tax incentives. One of the most popular tactics involves programs allowing investors to reduce the amounts typically allocated to cover tax costs. For example, in some countries, foreign investors can benefit from reduced corporate taxes, investment tax credits, and/or tax holidays.

- Simplified regulations. Governments often introduce new streamlined processes associated with business registration, reporting, and other business activities to ensure business ease. In the framework of such initiatives, countries can launch online portals for registrations, permits, and other related services.

- Financial incentives. Various grants and subsidies, as well as low-interest loans, can be included in this group.

- Special economic zones and free trade zones are designated areas where specific economic regulations are in force. These regulations may involve relaxed tax and customs rules.

- Regulatory reforms. To attract foreign investors, governments can implement new rules that better protect their rights and establish clear dispute resolution mechanisms. Such a mechanism should explain how investment disputes can be resolved if necessary.

For example, Singapore is known as an investment-friendly country. Foreign investors can enjoy a favorable tax regime, strong intellectual property protection, and a robust legal framework that supports business operations.

At the same time, China's key “secret” to attracting foreign investors is hidden in its enormous market potential, tax breaks and subsidies for a row of industries, and special economic zones.

It would also be interesting to examine the developing countries. Kenya, Egypt, South Africa, and Nigeria, known as Africa’s “Big Four,” continue to attract long-captured attention from investors from all over the globe. In 2023, these countries secured 90% of all startup funding in Africa. Though the region and the rest of the world experienced a dip in the financing and deal count in 2023, the tech industry there still looks quite promising from the perspective of VC investors.

The factors behind this interest are different, from the increase in the number of startups in Africa to the uniqueness of their ideas and innovations. Moreover, the African Continental Free Trade Area (AfCFTA) is also viewed as a powerful tool for attractive investments. However, the African market is not homogeneous; each country has peculiarities. While some are open to investors, in others, investment barriers are too high. This situation brightly demonstrates that region matters and that specific conditions are ensured in each market.

Final Word

Although the previous couple of years were not good ones for startups waiting for VC investments, 2024 can be a year when the tendencies will change. Experts predict that in 2024, we will observe a growth in the amount invested by venture capital firms and individuals ready to support startups.

The number of startups trying to win their market share is growing, which is an important factor boosting the competition for those who want to get venture capital. This means that entrepreneurs need to pay much more attention to the value of their ideas and the quality of their products even at the initial stages.

This principle also covers the technical aspects of their products if they are working on a project of this kind. That’s why it is vital to have reliable tech specialists by their side. It is not feasible for startups to hire in-house developers at the first steps of their business journey. Given this fact, establishing cooperation with a highly professional vendor is highly significant for their common success.

Do not hesitate to contact Geomotiv. Our software development team will support you in taking the first steps to build your software project.

At Geomotiv, we have solid expertise in various business domains. We have worked with companies of different types and sizes, including small companies, and know how to use the power of the most advanced technologies to deliver the value of your innovations to end-users.